Abiomed Inc. (NSDQ:ABMD) makes cardiac assist devices powerful enough to pump more than a gallon of blood through the heart each minute and small enough to be placed inside the heart via catheter. It’s a highly specialized, highly competitive market that’s difficult to break into.

At an investors meeting in Boston last week, the company sought to deliver the message that its devices offer a less invasive option than ventricular assist devices and don’t need to be combined with inotropic drugs as is often the case with intra-aortic balloon pumps. It’s been two years since Abiomed won 510(k) clearance from the Food & Drug Administration for its Impella 2.5 device; at the conference, CTO Dr. Thorsten Siess acknowledged that physicians have been slow to adopt the device.

“We’re not just bringing them a new device for a given indication,” he told MassDevice, “we’re changing the paradigm of how [doctors] treat their patients. How many times do you think we change the paradigm for how you treat your patients? Anywhere from 15 to 20 years. This is why it’s taking longer, but in the end I’m 100 percent sure that that’s going to happen.”

Dr. Siess explained that the sophistication of the device warranted a focused proselytizing for its use.

“It’s not about giving it to everyone, but making sure that the people who get it have appropriate training,” he explained. “Only then will we be able to sustain good outcomes. We’re committed to good outcomes, because it’s like if I gave you a Formula 1 race car, you would most likely kill yourself quickly. Everyone would want to drive one, but you really have to learn how to do it.”

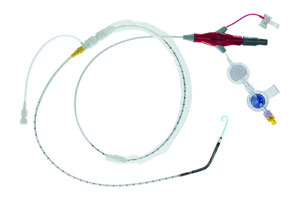

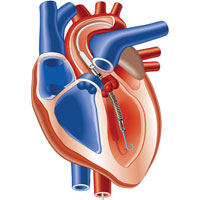

The Impella device

Despite the uphill battle for adoption, the Impella has its fans outside of the company. Dr. William O’Neill, who presented his research on the device at the meeting, expressed surprise that it’s not being used at more clinics across the country, given its effectiveness in allowing an injured heart muscle to heal more quickly after a cardiac event or related trama. And Abiomed touted the results of a new, European study showing the effectiveness of the Impella 2.5 in high-risk percutaneous coronary intervention procedures in December 2009.

MassDevice spoke with Abiomed president and CEO Michael Minogue following the investors meeting, to suss out how the company plans to boost its market penetration and what’s in store down the road.

MassDevice: Dr. O’Neill suggested that your projected adoption rates for the Impella are lower than he thought they will be. Your presentation noted that 10 percent of interventional cardiologists have been trained to use the Impella device. Is that a low number and are your projections overly conservative?

Michael Minogue: The run rate for Impella as a heart pump is equal to all of the other implantable VADs [ventricular assist devices] in the entire United States that have been out now for 10 years, so it’s really relative to how big you think the market is. And what Impella does is treat acute and chronic patients; the standard of care in the U.S. for hemodynamic support is an intra-aortic balloon pump, it’s not VADs. Impella has the ability to take the improvements and the science of VADs and put it into a percutaneous and safe catheter platform and initiate that benefit, similar to the same entry point as inotrope and balloon pump treatment. That’s why I think the numbers are small relative to a balloon, but they’re already on par with VADs. We have a long ramp with a very big opportunity.

MassDevice: During the presentation, the researchers presented data about patients who were at a very critical stages of cardiac trama and very old. They had very weak hearts. Are you planning other indications for the device? Is the device useful in other patient demographics?

MM: The Impella has 510(k) clearance for use on patients that need hemodynamic support. That hemodynamic support can be prophylactic use or emergency use. If you look at the current use of the IABP, there are 10 applications: 40 percent are prophylactic use and the other 60 percent are emergency use. What we think happens is the prophylactic allows you to train the site and get [hospitals] comfortable with the technology so they can use it more for emergency use.

We think Impella is a platform for high-risk patients that want to have minimally invasive treatment and who can be in the catheterization lab; it can be in the surgery suite, it could be in the [electrophysiology] lab, it could be the hybrid lab. That’s why there’s so much utility left to develop on the actual platform.

MassDevice: You mentioned a “long ramp.” What are you doing to get up that ramp?

MM: The ramp we’ve had to date has been pretty significant. It’s been four to 12 to 36 to 59, so we’ve had 200 percent growth, 200 percent growth and 1,500 percent growth, so that’s pretty steady. We have added people on the clinical side. We have 40 clinical people, we have 31 salespeople, we have 70 per diems and we continue to add two to four people per quarter in the U.S. to keep going.

MassDevice: What does that mean in terms of your business development spend — getting more doctors and hospitals to adopt the device?

MM: We do have a high and a premium spend on our sales and marketing, so we are spending the money required to train, to ramp up, get new users, and it’s at a rate that’s higher than a conventional company. It’s similar to a company that’s along the growth curve of introducing new technology.

MassDevice: Is there anything in the pipeline for new approvals?

MM: For a lot of this, the technology’s there. It’s just about getting more studies on the existing application. From our perspective, that’s a very enjoyable position to be in, because now you can actually increase your commercial productivity at the same center by just training more doctors and doing more applications. That’s where we are and that’s where we want to maintain our focus. Obviously we have a lot of IT and know-how so we can advance the technology. The first level of advancing is making the device easier to put in, quicker to put in, and enhancing the platform’s accuracy. From there, we’re going to have improvements of pressure sensing, quicker start-up, even from what we’ve done already, a newer console from what we’ve done already, and then we have a right-side percutaneous Impella pump that will be in our first patients in Europe over the next three months. That’s the next new product. After that, there’ll be an Impella pediatric pump and along those lines there’ll be incremental software improvements and other things that are happening on the platform itself.

It’s expanding into applications on what we have today: Training more doctors, either converting them or crossing them over from the balloon pump, and getting more hospitals to come on board. That’s where you get the commercial productivity.

MassDevice: In June, Abiomed restated its fourth-quarter earnings after the exit from a lease on a large facility in Ireland. You also sold off a big stake in World Heart Corp. (NSDQ:WHRT). Can you give us a sense of Abiomed’s financial picture following the restatement and the stock sale?

MM: We restated, in that the initial analysis was that we could have taken the charge last quarter for our Ireland plan. Upon further review, because there were cubicles left in there, we did not need to take the charge last quarter and we’re taking it in the second quarter. By taking that charge out of last quarter, our quarter was even better.

In the case of our cash burn rate, it has significantly gone down. For the year, it was $2.8 million, which is the lowest in our history, but then if you go by quarter, it went from $6 million to $2.5 million to $600,000 and in Q4, without the World Heart sale of stock, we still had $200,000 in cash from all other operations. So we had a nice movement from high cash burn to $200,000 positive and, on top of that, we sold $6.4 million in World Heart shares that added to our balance sheet. The trend has been positive and the trend, without the stock sale, still got us through a positive cash number in Q4.

The answer is that we’re in a good position from both of those, because the cash is an ongoing thing and we put the Ireland expense behind us.

MassDevice: What’s behind the reduced burn rate?

MM: The cash burn rate is improving because our revenue is going up. Our break-even number, for cash, is around $26 million to $28 million and we’ve been increasing our revenue every quarter. The revenue on Impella and the re-order has a very strong gross margin and it’s growing, so it’s a good problem. We’re moving in the right way across the board and we are being disciplined on our budgets outside of the marketing activities that are required — the other side of our budget.